In the rapidly changing digital landscape, technology has reshaped the way we manage and interact with our finances, with one of the most prominent being digital wallets. From contactless payments to wearable tech, QR codes, and more, technology is the driving force behind shifting capabilities and functionalities in digital wallets, enhancing security, accessibility, and user experience. We’ll explore the ways digital wallets have been revolutionizing digital wallets, shedding light on the impact they have on our financial transactions, from payday loans to peer-to-peer transactions and more. Let’s get rolling.

1. Mobile payments

Mobile payment capabilities have revolutionized how we conduct transactions, making them easier and more secure than ever before. The adoption of smartphones has been fundamental to the prevalence of mobile payments, providing the necessary hardware to enable secure and convenient payment processing. They serve as the foundation for mobile wallets, allowing users to complete a payment with a simple tap from their phones.

2. Biometric authentication

Biometric authentication is another integration in digital wallets, enhancing both convenience and security. These biometric sensors, like fingerprint scanners and facial recognition software, capture biometric data for authentication. The biometric data is encrypted using algorithms, and the data is solely stored on the user’s device, providing an additional layer of security.

As this form of authentication grows in prevalence, machine learning and AI technology are continuously improved for accuracy and speed, adapting to variations in the data to make authentication more reliable. Anti-spoofing measures are also employed, designed to counter fraudulent attempts to cypress authentication using fake fingerprints or facial imagery.

3. Contactless payments

Technology is also a driving force in facilitating contactless payments within digital wallets. To make it as simple as a tap from your phone to the payment screen, near-field communication (NFC) technology is required to facilitate communication between both devices. Mobile payment systems such as Apply Pay and Google Pay utilize NFC to complete contactless transactions.

One technological feature that promotes security in contactless payments is secure payment tokens. Instead of transmitting credit or debit card information, digital wallets generate tokens to represent the necessary payment information. This adds an extra buffer of security by minimizing the risks associated with transmitting sensitive information during transactions. Additionally, the integration of contactless payment technology into wearable devices like smartwatches enhances convenience and offers a range of options for completing transactions.

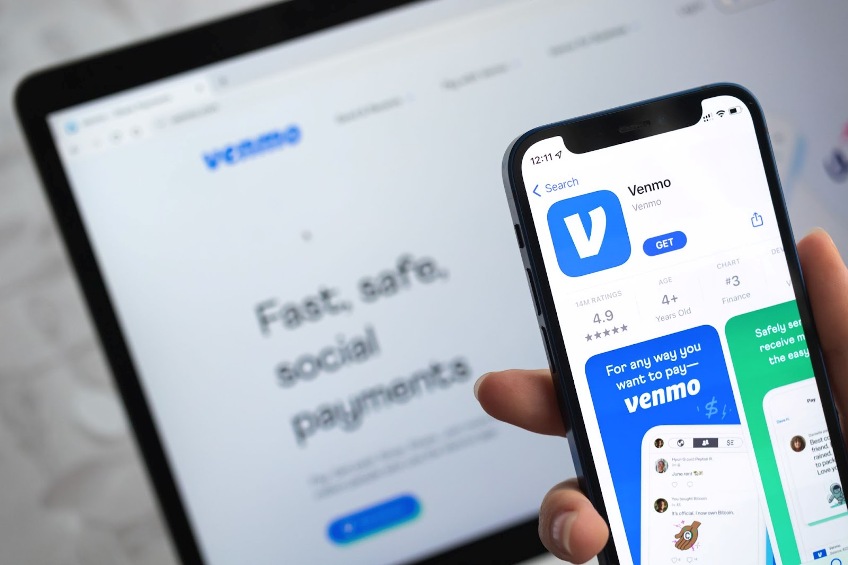

4. Peer-to-peer (P2P) payments

Peer-to-peer transactions are another revolution in digital wallets, popularizing transfers to one another. Applications such as Venmo and Zelle are designed for this type of transaction, offering an intuitive interface and simplifying fund transfers, contact management, and transaction tracking.

Digital wallets enable easy fund transfers by allowing users to send funds to their friends, family, or anyone else as long as they have a registered digital wallet using their phone number, email address, or QR codes linked to the recipient’s digital wallet. Conducting transactions in real-time enhances the user experience by providing immediate accessibility and convenience.

P2P transaction technology also offers robust security for users by employing encryption and tokenization, as mentioned above, in contactless payments. By linking your personal banking accounts to your digital wallet, you simplify fund transfers, allowing you to complete payments through smartphones, tablets, and computers.

5. Cryptocurrency

The integration of cryptocurrency within digital wallets wouldn’t be possible without the help of technology. Blockchain technology allows for a decentralized and distributed ledger, securely storing records on all cryptographic transactions. This provides transparency and security.

Cryptography remains the cornerstone of cryptocurrency technology, offering secure methods for digital wallets through private and public keys. Public keys are used for withdrawing funds, while private keys are used to authorize ongoing transactions, providing a private key only known to the digital wallet owner.

These technological advancements promoted the creation of wallet applications to manage, send, and receive cryptocurrencies through a unified platform. Modern digital wallets often support not just one type of crypto but multiple options, including Bitcoin, Ethereum, and more.

6. Wearable tech

And the ease of transactions isn’t exclusive to your smartphones. Wearable technology has made significant strides, especially when it comes to our digital wallets. This wearable devices use near-field communication and radio frequency identification to enable seamless communication between wearables and point-of-sale (POS) terminals, facilitating contactless transactions.

Wearable devices like smartwatches and fitness trackers are equipped with technology to host digital wallets. By linking apartment information to the wearables, you eliminate the need to carry a smartphone or physical wallet to complete a transaction.

Like some of the other technologies we’ve mentioned in this article, wearable technology is also equipped with robust security measures. As wearables increasingly become a part of the Internet of Things (IoT) ecosystem, allowing them to interact with other IoT devices for transportation or shopping, wearable technology for digital wallets has been seamlessly integrated into daily life.

7. IoT integration

The integration of IoT devices with digital wallets creates an interconnected environment for financial transactions. Standardized communication protocols like message queuing telemetry transport (MQTT) and constrained application protocol (CoAP) facilitate efficiency and reliable communication between IoT devices and digital wallets, allowing for secure data exchange.

Additionally, NFC and radio frequency identification (RFID) technologies are mandatory for enabling IoT integration into digital wallets, enabling contactless payments with a simple tap of the screen. Developers leverage APIs and software development kits (SDKs) to integrate digital wallet functionality into IoT, streamlining the development process and ensuring compatibility between devices.

8. QR codes

Technology has also led to the use and integration of QR codes in digital wallets. The generation and scanning of QR codes enable payment details like amount, recipient information, and transaction references. Digital wallets can easily scan QR codes, streamlining the transaction process.

The adoption of QR codes coincides with the growing popularity of contactless transactions. Because of this, QR code scanning has become the standard for initiating payments through advanced encryption and security measures, solidifying the safety of payment information transmitted through QR codes.

The Revolution of Digital Wallets

It’s no secret that digital wallets have been propelled by technological advancements, ushering in a new era of financial convenience and security. From easy contactless payments and biometric authentication to IoT connectivity and cryptocurrency, digital wallets are continuously evolving. By embracing these shifts, we enhance our financial experiences and streamline day-to-day transactions, making managing our finances simpler than ever before.