A sidechain is an emerging mechanism that allows transferring tokens from one blockchain to another and then securely using them to move back to the original blockchain if needed. As a result, sidechain functionality has tremendous potential to enhance existing blockchain capabilities.

How Does Sidechain Work?

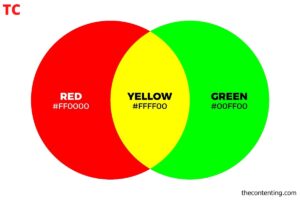

In technical terms, a sidechain is a separate blockchain synchronized with its parent blockchain through a two-way peg. The two-way peg is designed to exchange assets between the parent blockchain and the Sidechain at a predetermined rate.

A blockchain is typically referred to by its original name, the ‘main chain,’ while any additional blockchains are referred to as a ‘sidechain.’The parent chain requires users to send their coins to an output address, where they become locked so they cannot be used elsewhere.

Upon completion of a transaction, a confirmation is communicated across chains, followed by a waiting period. Upon the completion of the waiting period, the equivalent number of coins are released on the Sidechain, which allows the user to access and spend it. When moving from one Sidechain to another, the reverse process occurs.

Some of the Components of Sidechains are:

Federations

There are several types of federations, but the most commonly used type acts as an intermediary point between the main chain and one of its side chains. For example, when a user has used a coin, a group determines when the coin is locked up and released back to the user.

In this case, the creators of the Sidechain are in charge of choosing the members of the federation. Adding another layer between the main chain and the Sidechain is one of the problems with federation structures.

Security

A sidechain is responsible for the security of its transactions. It is possible to hack if there is not enough mining power. Sidechains are independent, so if it is compromised, the damage will be contained within that chain and won’t affect the main chain.

However, if the main chain were to be compromised, the Sidechain would still be able to operate, but it would lose most of its value. Therefore, there is a need for Sidechain to have their miners. The miners can be incentivized by ‘merged mining,’ which allows two cryptocurrencies with the same algorithm to be mined simultaneously.

Importance Of Sidechain Blockchain

Blockchain participants and developers use Sidechain to test features and experience other use cases unavailable on the main network chain. It is also possible to use it to speed up transactions’ finality and lower overall transaction costs.

In order to make blockchains more accessible, sidechains work in a crucial way, as they allow users to use their held crypto assets for various purposes.

For example, when dealing with bitcoin transactions, you don’t have to worry about paying any fees or waiting hours for the transaction to be validated.

Components of Sidechain Blockchain

Two-way Peg

The purpose of sidechain blockchain has been to facilitate the transfer of digital assets from one blockchain to another, regardless of whose asset it is being transferred. Ideally, digital assets should be transferable without having to worry about counterparty risk – meaning that no third party should be able to prevent the asset transfer from taking place.

Therefore, there is a need for a two-way peg to facilitate the transfer of data between blockchains back and forth. A two-way peg is a mechanism that allows for digital assets like bitcoin to be transferred back and forth between the mainnet and the new Sidechain regularly.

However, it is interesting to note that a “transfer” of a digital asset does not occur. Instead of transferring assets, they are locked on the mainnet while the equivalent amount is unlocked on the Sidechain. Consequently, any two-way pegged operation must be based on the assumption that the actors involved, or “validators,” in the two-way pegged operation are acting honestly on both sides.

Smart Contracts

It is necessary to build an off-chain process – transactions that happen outside the parent blockchain – to transfer data between the sidechain blockchain and the mainnet. Digital assets are locked in and released on either end of the two blockchains once a smart contract validates the transaction between the parent chain and Sidechain.

The transfer of digital assets between a parent chain and a sidechain is imaginary. Therefore, digital assets are locked in and released on either end of the two blockchains once a smart contract validates the transaction. The use of smart contracts on the mainnet and it helps ensure that foul play is minimized by enforcing the integrity of the validators on the mainnet and Sidechain in confirming cross-chain transactions honestly.

When a transaction occurs, a smart contract will notify the mainnet. The information regarding a transaction will then be relayed to a smart contract on the sidechain blockchain via the off-chain process, allowing it to be verified. It can release funds on the Sidechain once the event is verified. By releasing funds, users can simultaneously move digital assets between both blockchains.

Bitcoin’s Sidechain

There are a few real-world examples of Sidechain, such as Bitcoin’s Liquid Network and Rootstock (RSK). It is only possible to perform activities involving Bitcoin on both Sidechains since they are tied to Bitcoin’s mainnet.

The Liquid Network of bitcoin is a sidechain built on Bitcoin’s mainnet by blockchain and an open-source project. As a result, Liquid Network’s block discovery time is just one minute, which is much faster than Bitcoin’s block time of ten minutes. Furthermore, with the Sidechain, you can add ten times as many blocks as with Bitcoin’s blockchain.

It is also possible to transact digital assets on the network more privately, as the amount and type of asset being transferred are masked. RSK sidechains are specifically designed to run smart contracts. RSK locks bitcoin on the Mainnet and releases it as smart bitcoin (SBTC), its native currency.

RSK’s smart contract proficiency allows users to use smart contracts without converting their bitcoin into other assets. In other words, they are interoperable with other blockchain networks, such as Ethereum.

Conclusion

With the help of Sidechains whether it is Polygon, Ethereum, or pegged sidechains, cryptocurrencies can be greatly enhanced, the mining costs reduced, and the ability to transfer assets between blockchains made possible.

There are multiple approaches to integrating different blockchains with varying levels of security trade-offs. Despite the complexity of building a sidechain, a pre-existing solution by the professional blockchain development company can simplify the application’s architecture, allowing it to support multiple cryptocurrencies with one codebase.

Read Next Blog:

Guide on How Money Made from Metaverse